SoFi was created to address the country's student loan debt problem by making it easier for borrowers to refinance their debts. Eventually, it broadened its emphasis to encompass various financial goods and services, including SoFi Checking & Savings. In this in-depth review, we'll look at the product's checking and savings features, high-interest APY, and general convenience and decide if it's a suitable fit for you!

SoFi Checking and Savings is offered through SoFi Bank, N.A. Member FDIC. The SoFi® Bank Debit Mastercard® is issued by SoFi Bank, N.A., pursuant to license by Mastercard International Incorporated and can be used everywhere Mastercard is accepted. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.

What is it?

What Is SoFi?

With SoFi's online banking services, your funds above $250,000 are stored at different banks through the SoFi Insured Deposit Program. SoFi works with multiple banks, each providing $250,000 in FDIC insurance, allowing your money to be protected up to $2,000,000, which is much higher than traditional banks.

SoFi manages your account, but a different bank stores the actual physical funds. This means that your money is FDIC-protected as it is distributed across the network of banks. The SoFi Insured Deposit Program is designed to provide the best benefits to SoFi members, offering enhanced insurance while still providing uninterrupted access to all their funds within SoFi Checking and Savings.

By working with multiple banks, SoFi is able to offer additional FDIC insurance seamlessly, ensuring that members have peace of mind about their money at SoFi. This additional insurance coverage is a significant advantage over the industry standard of $250,000 per account, making SoFi an attractive option for those seeking higher levels of protection for their deposits.

SoFi Checking & Savings

What Is SoFi Checking & Savings?

With SoFi's online bank account, you'll get a high-interest rate of 4.50% APY on savings balances (1.20% without direct deposit), but you also get a debit card that can be used to make purchases from the same account.

There are no account fees, minimum balance requirements, monthly maintenance costs, insufficient funds fees, and no overdraft fees. Personal checks, bill pay, and transfers are also all available for free. SoFi will not impose a foreign transaction fee if you use their debit card outside of the United States. Additionally, there are no ATM fees on all Allpoint locations.

Finally, you receive a SoFi membership, which enables you to attend exclusive activities and have priority access at SoFi events. While this isn't a totally exclusive membership, it is a nice little bonus that you may take advantage of if you live close to where these events are held, like in Los Angeles or New York City.

Open An Account

How To Open A SoFi Account?

It only takes a few minutes to apply and get accepted!

On the first screen, you must register for SoFi's online bank account by providing your full name, email address, and password.

After that, you must decide whether to create an individual or joint account.

Up To $300 Sign Up Bonus

Then, you must provide your permanent address. SoFi utilizes a technology to assist in populating your address, similar to how Google Maps auto-populates as you input, making the process incredibly quick. After that, you provide a mobile phone number for two-factor authentication to ensure your account is secure. Finally, you must verify your identity by providing your date of birth and SSN. After this, your account should be automatically approved, and you should be good to go!

Funding Account

How Do I Fund A SoFi Account?

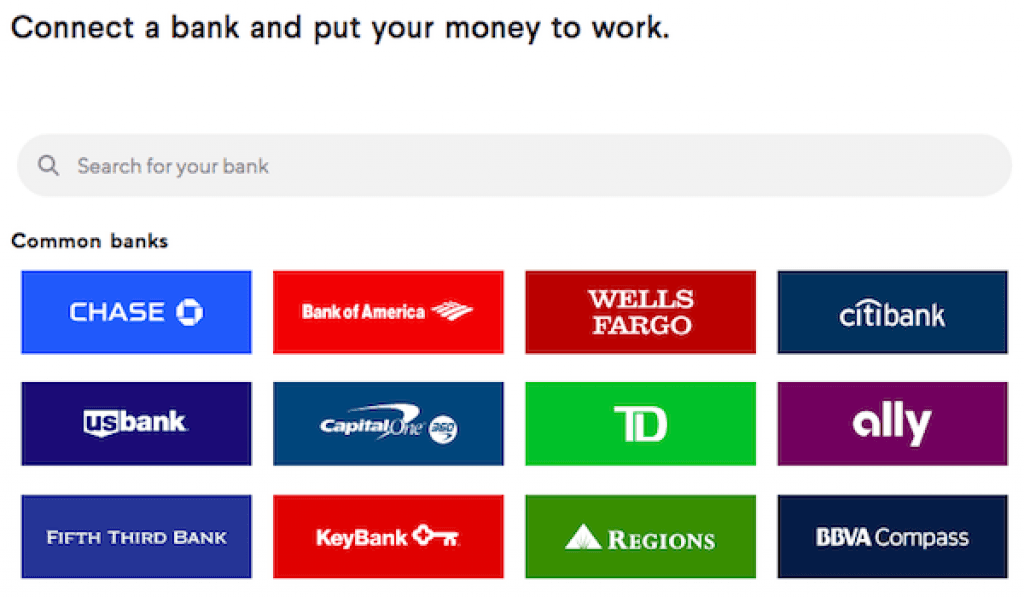

It's also relatively simple to fund your new SoFi online bank account. All you do is link your current bank to their platform and initiate a transfer – it's as simple as that! The transfer only takes only a few days to complete, which is usual for an ACH transaction, and there are no transaction fees!

Pros & Cons

Pros And Cons SoFi's Online Bank Account

To avoid fraud, SoFi limits you to a fixed amount of transactions.

Withdrawals from peer to peer are limited to $1,000 per day and $3,000 per month. The maximum amount you may pay in one transaction is $5,000.

You can only withdraw $1,000 from an ATM or a point-of-sale cash machine. The amount of cash you may withdraw over the counter is restricted to $150, while the amount you can spend at the point of sale is limited to $6,000. Finally, you have a daily restriction of 12 point-of-sale transactions.

How Does It Compare?

How Does SoFi Checking & Savings Compare?

When choosing SoFi's online bank account, it's important to understand how it's fundamentally different than traditional banks. Hopefully, this table below can help you visualize some of the differences. Additionally, if you want to try another free bank with up to 5.0% APY, read our Aspiration review to see if it's right for you!

Bottom Line

Is Sofi Checking & Savings For You?

SoFi's online bank account provides you with many competitive services you will probably use that most traditional banks do not offer. However, if you're looking for a similar alternative with a higher APY, consider Aspiration. Either way, you'll receive everything you need to pay bills, save money, withdraw at fee-free Allpoint ATMs, and attend exclusive events only available to SoFi members.

SoFi members with Direct Deposit or $5,000 or more in Qualifying Deposits during the 30-Day Evaluation Period can earn 4.50% annual percentage yield (APY) on savings balances (including Vaults) and 0.50% APY on checking balances. There is no minimum Direct Deposit amount required to qualify for the stated interest rate. Members without either Direct Deposit or Qualifying Deposits, during the 30-Day Evaluation Period will earn 1.20% APY on savings balances (including Vaults) and 0.50% APY on checking balances. Interest rates are variable and subject to change at any time. These rates are current as of 8/9/2023. There is no minimum balance requirement. Additional information can be found at http://www.sofi.com/legal/banking-rate-sheet.