Saving money is an essential part of financial security. With so many saving options available, it can be challenging to decide which option is best for you. In this article, we will review the Upgrade Premier Savings Account, which offers an attractive interest rate of 5.21%. We will explore its features, benefits, drawbacks, and how to get started with the account.

What is it?

What is Upgrade's Premier Savings Account?

The Upgrade Premier Savings Account is an FDIC-insured online high-yield savings account through Cross River Bank that offers competitive interest rates in the market. It is a great option for those who want to save money and earn higher interest rates than traditional savings accounts.

Upgrade Bank was founded in 2017 by a group of financial industry veterans with a mission to provide borrowers access to more affordable credit and exceptional customer service. The bank has quickly become a trusted name in the industry and has helped thousands of customers achieve their financial goals.

Open an account

How to Open an Upgrade Premier Savings Account

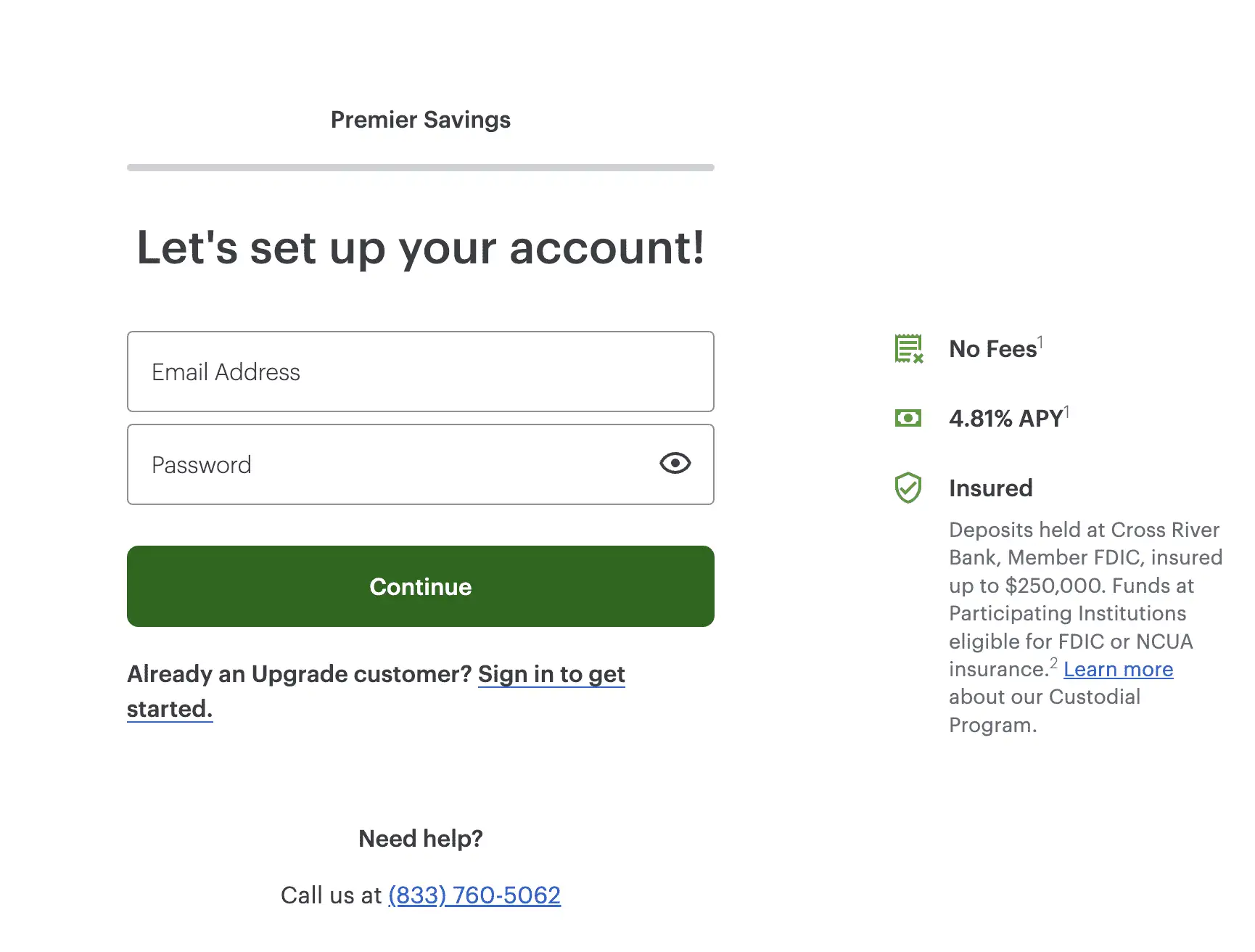

Opening an Upgrade Premier Savings Account is easy and can be done online in just a few minutes. Simply visit the Upgrade Bank website and follow the instructions to open your account. You will need to provide some basic information, such as your name, address, and social security number.

Once your account is open, you can start depositing funds and earning interest right away. You can also set up automatic savings plans to make saving money even easier.

Features

Top Features of Upgrade Premier Savings

The Upgrade Premier Savings Account offers the following features:

- Competitive annual percentage yield (APY) of 5.21% APY, which is significantly higher than the average national savings account rate.

- No minimum balance requirements or monthly maintenance fees.

- FDIC-insured savings up to $250,000 through Cross River Bank.

- Ability to link external accounts to fund transfers effortlessly.

- Easy-to-use mobile application and online banking platform.

The high APY of 5.21% is significant considering the average national savings account rate, which is currently at 0.05%. It means you can earn more interest on your savings and reach your financial goals faster.

But that's not all Upgrade Premier Savings has to offer. Here are some additional features that make this account stand out:

No Hidden Fees

Unlike other savings accounts, Upgrade Premier Savings has no hidden fees. You won't have to worry about being charged for monthly maintenance or other unexpected charges. This means you can save more of your hard-earned money and watch it grow.

Easy Account Management

Upgrade Premier Savings offers an easy-to-use mobile application and online banking platform. You can access your account information, transfer funds, and manage your savings from anywhere at any time.

Customer Support

Upgrade Premier Savings has a dedicated customer support team that is available to help you with any questions or concerns you may have. Whether you need assistance setting up your account or have a question about a transaction, their team is there to help.

Security

Your security is a top priority at Upgrade Premier Savings. They use industry-standard encryption to protect your personal and financial information. You can rest assured that your savings are safe and secure.

Pros & Cons

Upgrade Premier Savings Pros & Cons

If you're looking for a savings account that offers a high annual percentage yield (APY) and a user-friendly mobile application, the Upgrade Premier Savings Account may be just what you need. While it has several benefits, it also has its drawbacks. Below are some of its pros and cons:

Getting Started

Getting Started with Upgrade Premier Savings Account

Upgrade Premier Savings Account is one of the best savings accounts available in the market. It offers competitive interest rates and no monthly maintenance fees. If you are looking for a secure and reliable savings account, Upgrade Premier Savings Account is the right choice for you.

The process to open an Upgrade Premier Savings Account is quite straightforward and takes just a few minutes. Here are the steps:

- Visit the Upgrade website and click on “Open Account.”

- Fill out your personal information, including your name, address, date of birth, and social security number.

- Select the type of account you’re opening.

- Confirm your identity by answering a few security questions and providing a valid government-issued ID.

- Make an initial deposit. You can transfer funds from an external account or mail a check to Upgrade.

Upgrade Premier Savings Account is FDIC insured through Cross River Bank, which means your money is safe and secure. FDIC insurance covers up to $250,000 per depositor, per account ownership category, in case of bank failure.

Upgrade Premier Savings Account offers a high annual percentage yield (APY) compared to other savings accounts. The interest rate is variable and is subject to change without notice. You can earn interest on your savings and watch your money grow over time.

Upgrade Premier Savings Account has no monthly maintenance fees, no minimum balance requirements, and no transaction fees. You can access your account online or through the mobile app, making it easy to manage your savings from anywhere.

Upgrade Premier Savings Account also offers a feature called AutoSave, which allows you to set up automatic transfers from your checking account to your savings account. This feature helps you save money without even thinking about it.

Support

Account Access and Support

Upgrade offers an easy-to-use online banking platform that lets you manage your account and access your funds 24/7. With just a few clicks, you can view your account balance, transfer funds, pay bills, and even deposit checks using your smartphone camera. The online banking platform is secure and user-friendly, making it easy for you to stay on top of your finances.

In addition to the online banking platform, Upgrade also provides phone support from 6 am to 6 pm (PT) every day of the week. The customer support team is knowledgeable and friendly, and they are always ready to assist you with any questions or concerns you may have. Whether you need help with a transaction or you simply want to know more about the bank's products and services, the customer support team is just a phone call away.

Upgrade also offers a live chat feature on its website, which allows you to connect with a customer support representative in real time. This feature is especially useful if you prefer to communicate via text or if you need help outside of phone support hours. The live chat feature is available 24/7, so you can get the help you need whenever you need it.

Upgrade is committed to providing exceptional customer service, and they understand that every customer's needs are unique. That's why they offer personalized support to help you achieve your financial goals. Whether you're looking to save for a vacation, pay off debt, or invest in your future, Upgrade has the tools and resources to help you succeed.

Bottom Line

Is Upgrade's Premier Savings Account For You?

The Upgrade Premier Savings Account is an excellent option for those looking to earn higher interest rates on their savings. With no minimum deposit and monthly fees and easy account access, the bank offers an ideal platform for users looking to grow their money.

However, the lack of ATM access and full banking services may be a drawback for some users. Overall, the Upgrade Premier Savings Account is a competitive savings account that can help meet your financial goals.

FAQ

Frequently Asked Questions (FAQs)

What is the minimum deposit required to open an account?

There is no minimum to open an account, but Upgrade requires a $1,000 minimum deposit in order to earn the APY.

How do I fund my account?

You can fund your account by transferring funds from an existing external account.

Is Upgrade Premier Savings FDIC-insured?

Yes, the Upgrade Premier Savings Account is FDIC-insured up to $250,000 per depositor through Cross River Bank.

How is interest calculated on the account?

Interest is calculated daily and compounded monthly, which means your interest will be deposited once a month, but it is still being compounded daily.

Disclaimer

The Annual Percentage Yield (“APY”) for the Premier Savings account is variable and may change at any time. There is no minimum balance to open your account, but you will only earn the APY on days when the closing balance of your Premiere Savings account is or exceeds $1000. On days where the account closing balance drops below $1000, the APY will be 0%. There are no account fees, overdraft fees, or transfer fees associated with Premier Savings accounts. Upgrade is a financial technology company, not a bank. Premier Savings accounts are provided by Cross River Bank, Member FDIC.