What is it?

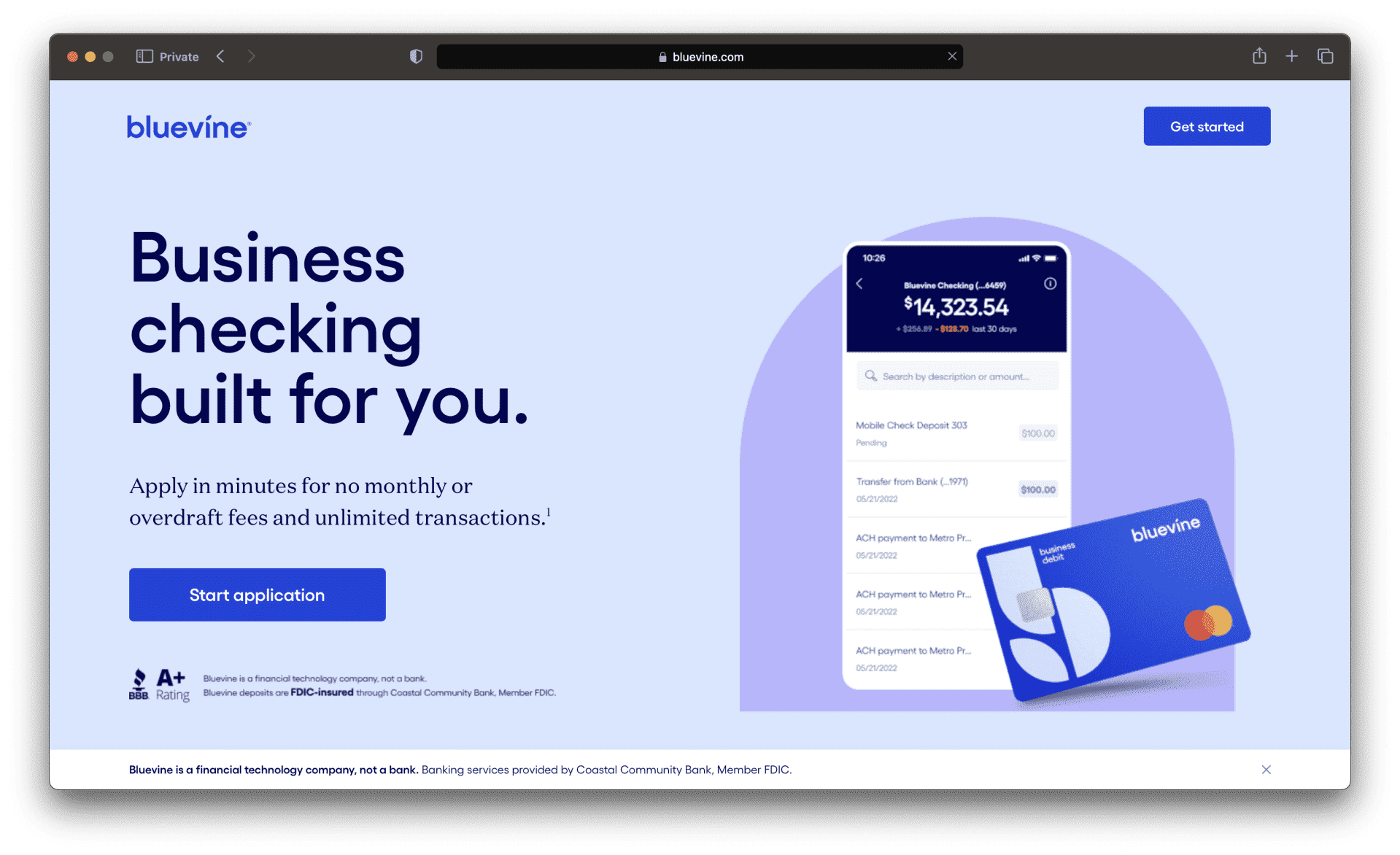

What is Bluevine?

Bluevine is a financial services company that offers business banking services. They have an online checking account that gives businesses access to a competitive 2.0% APY yield and other features, such as free bank transfers and no minimum balance requirements, without the fees commonly associated with brick-and-mortar banks. Bluevine does not offer any other banking products, such as savings accounts. However, it does provide loans and business credit, which can help you jump-start your business with a fast cash infusion.

Open Account

How to Open a Bluevine Account

Total Time: 5 minutes

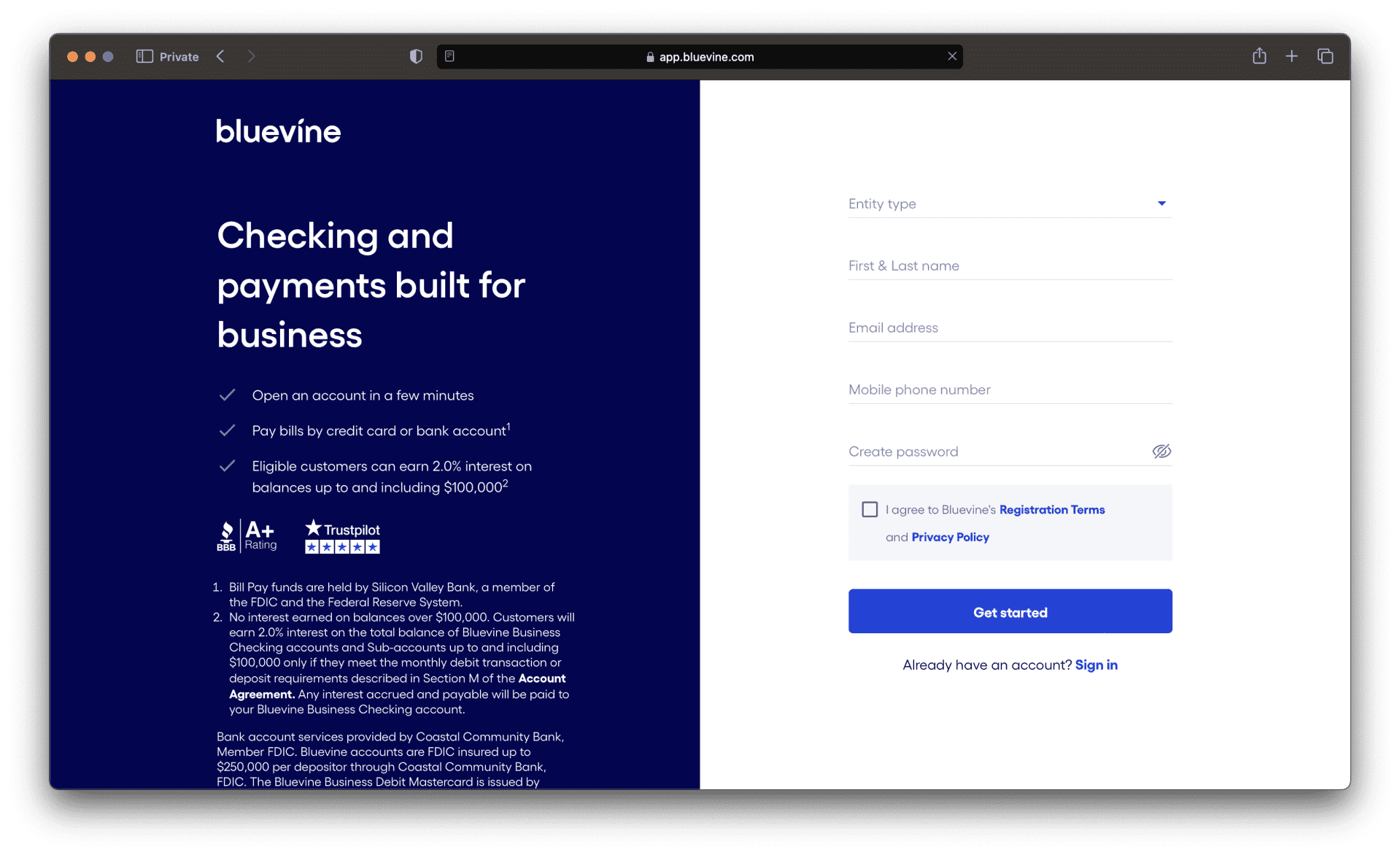

Start Application

Click “Start Application” to begin applying for a Bluevine Checking Account.

Enter Basic Information

Enter your entity type, full name, email, and phone number.

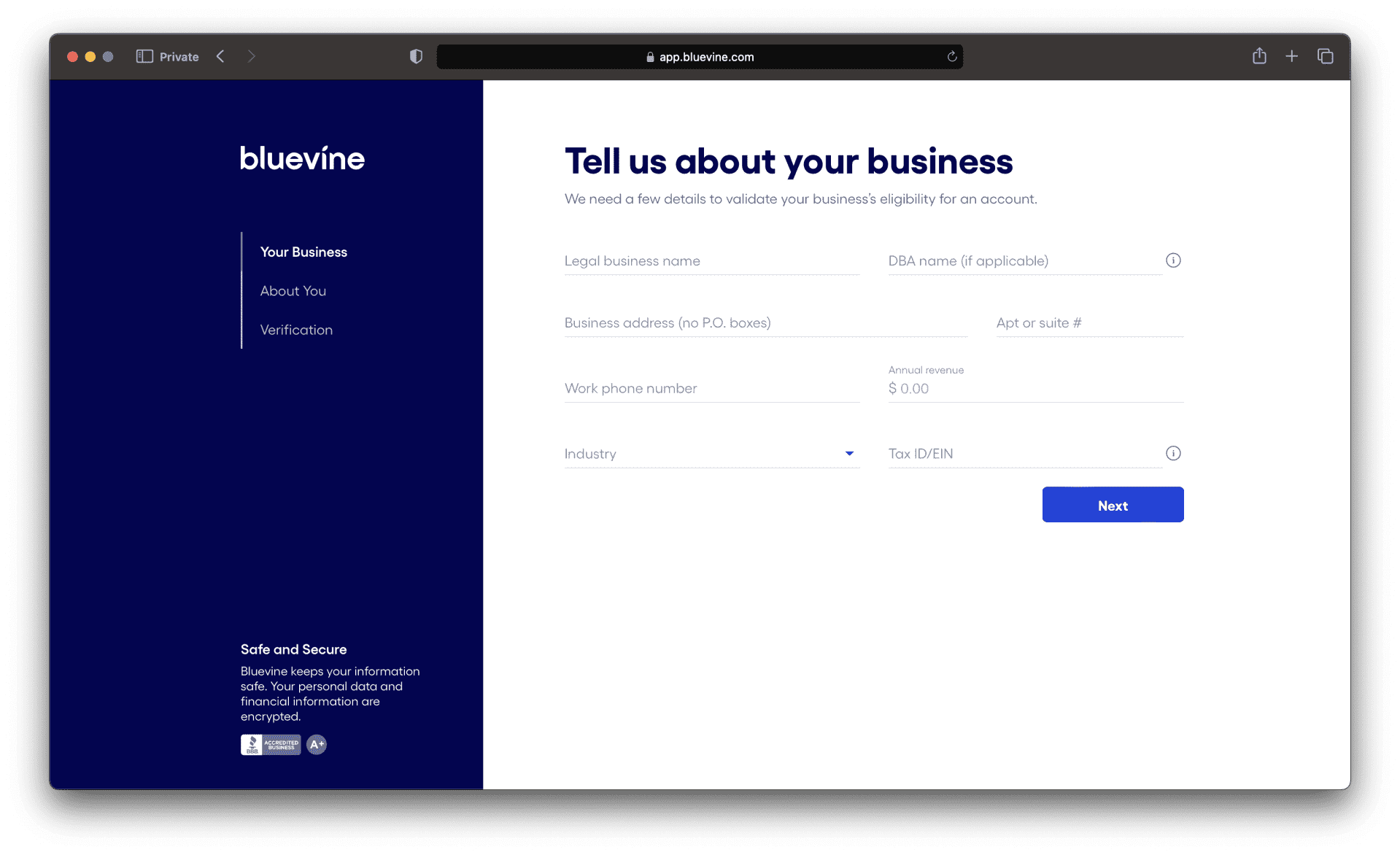

Enter Business Information

Enter your business information like its name, address, phone number, and more.

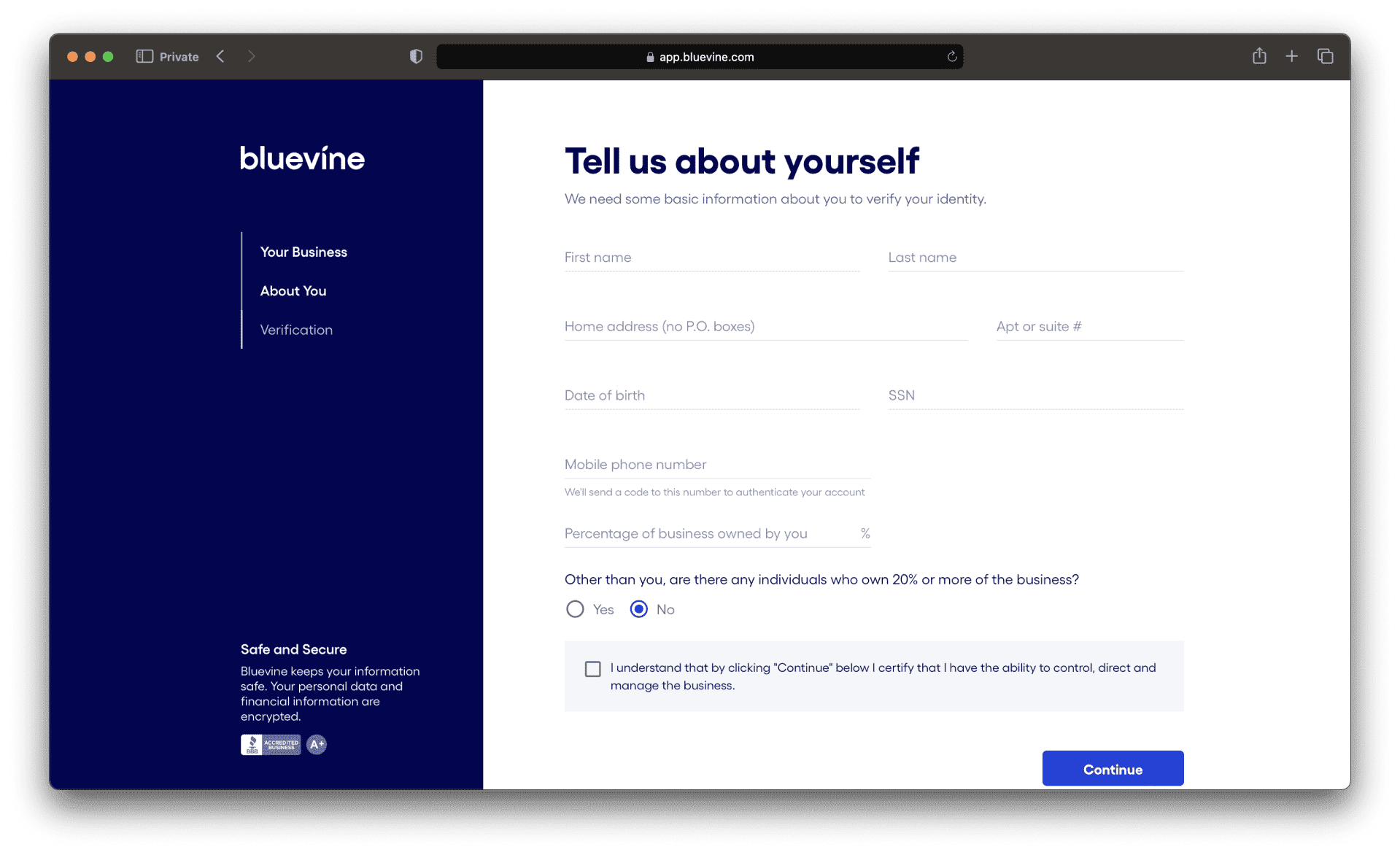

Enter Personal Information

Enter your personal information like your SSN, DOB, and more. This information is required by law to be stored securely.

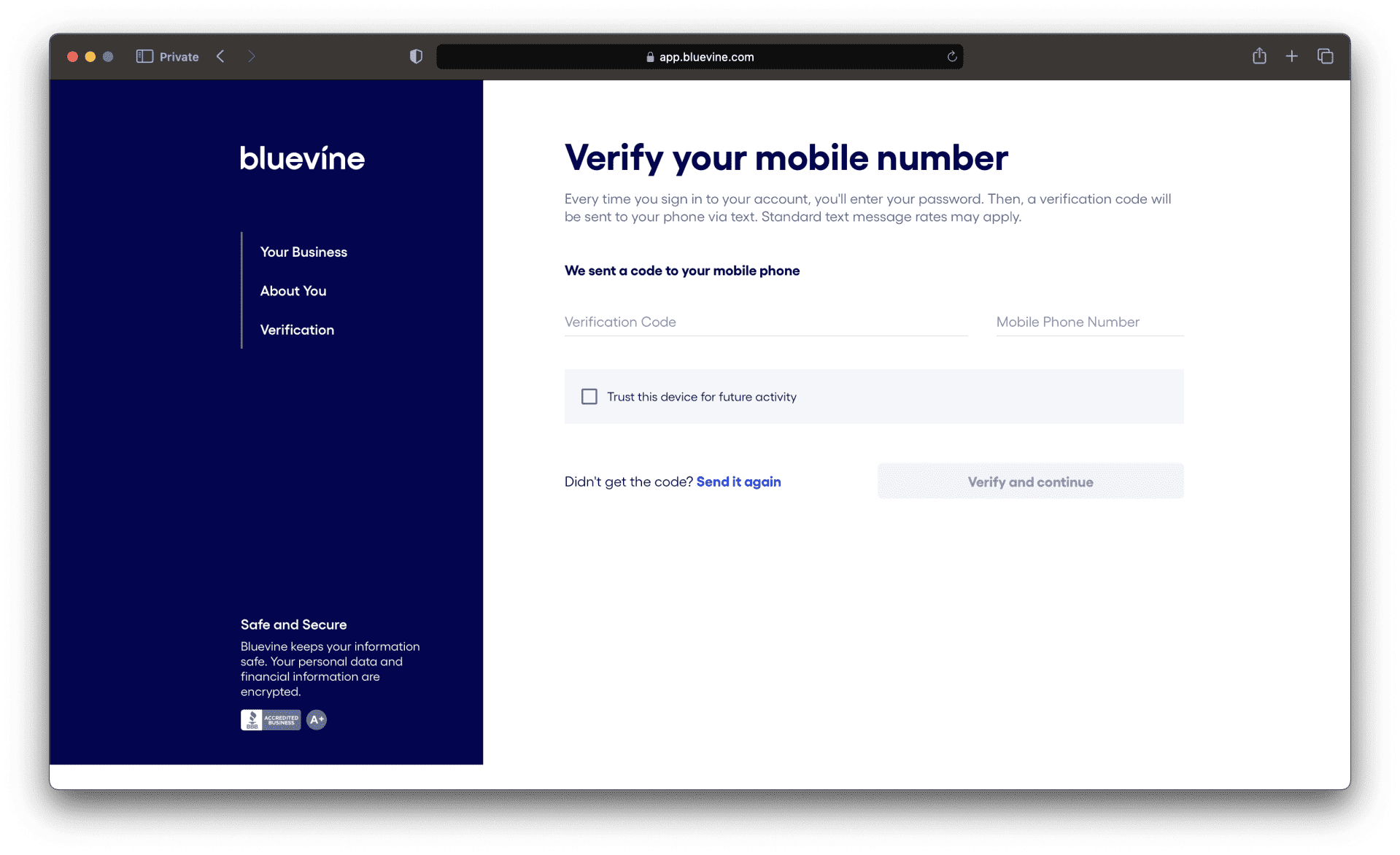

Secure Your Account

Verify your mobile number to secure your account.

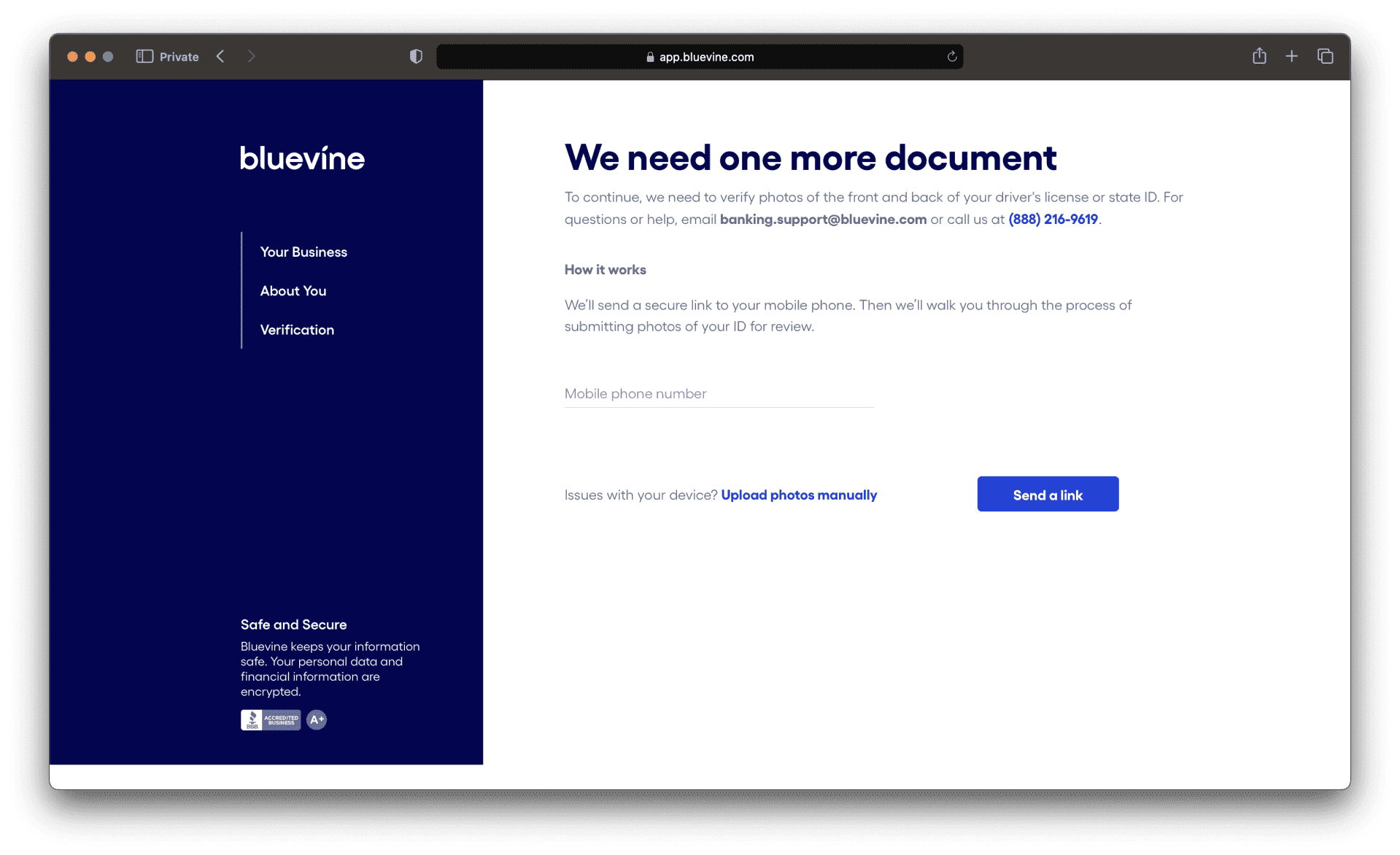

Manual Verification (Rarely happens)

You may have to upload a picture of your ID, driver's license, or passport to confirm your identity, but this only sometimes happens.

Approval

That's it. Your account should be approved within 48 hours if every step was followed correctly!

Pros & Cons

Pros and Cons of Bluevine

Features

Bluevine Top Features

Free Checking Account

The Bluevine business checking account currently offers the highest business APY of 2.0%, no fees, and unlimited transactions. Plus, there are no minimum balance requirements and free bank transfers.

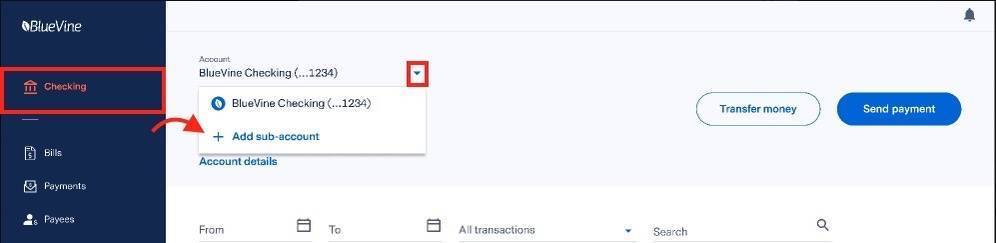

Subaccounts

Bluevine allows you to open multiple accounts dubbed ‘subaccounts,' which can be used to manage money, track spending in different areas of your business, and optimize cash flow.

For example, if you need a payroll account or a specific type of expense account that doesn't require you to deposit cash or use a debit card, subaccounts will be tremendously helpful. The combined balances of the subaccounts will help calculate your monthly interest, which is applied to your primary account.

Business Loans & Lines Of Credit

Bluevine offers business loans and lines of credit, which can provide you with a fast cash infusion for your business. Bluevine offers competitive business loan rates and terms with no origination fees.

Free Debit Card

Bluevine offers a free Visa debit card to access your funds quickly. Plus, you can use the debit card anywhere that accepts Visa debit.

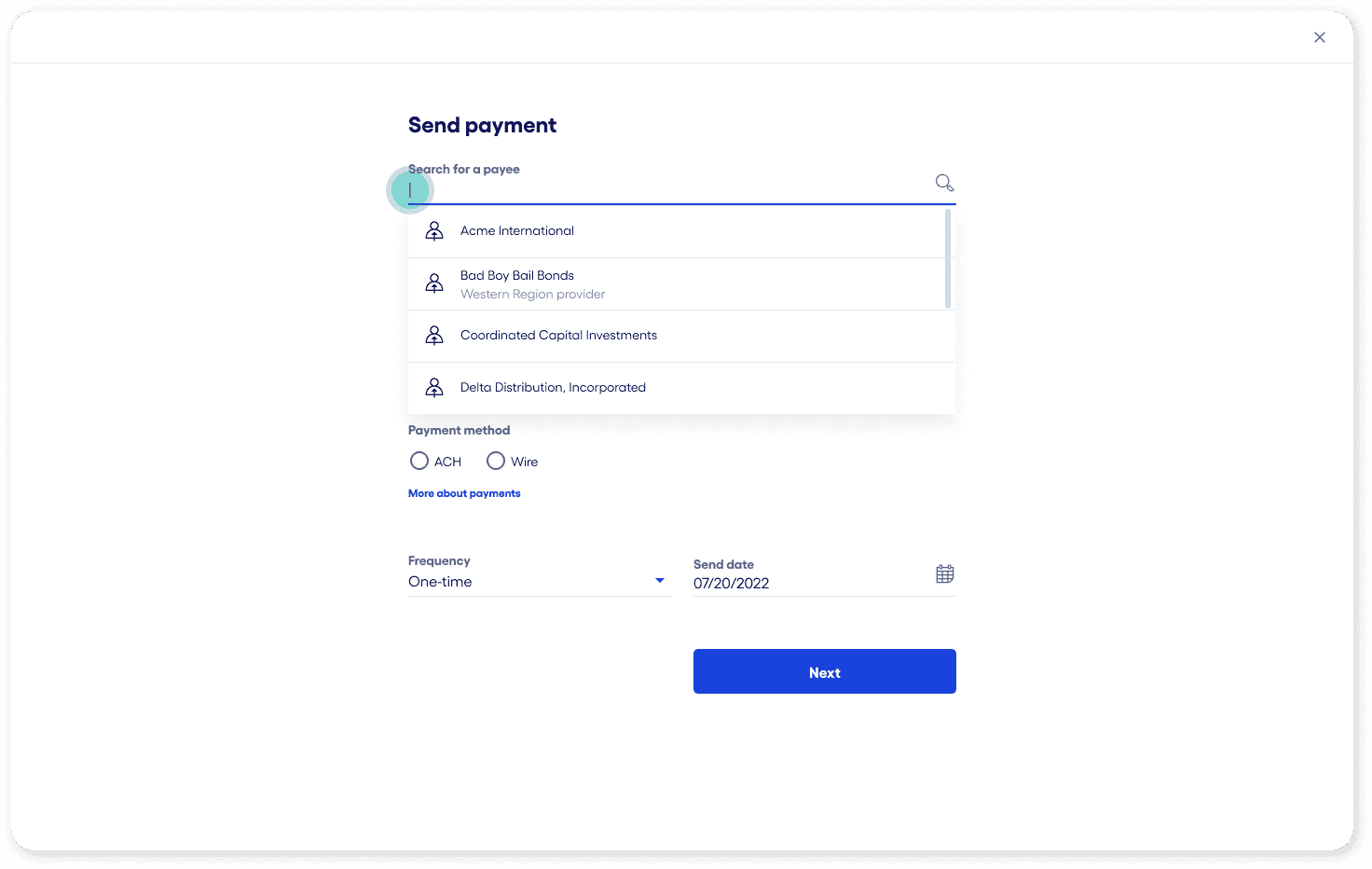

Bill Pay

Bluevine offers free bill pay services to manage your bills and payments easily. Quickly pay vendors with ACH and wire payments (domestic & international), make recurring payments, or send a physical check just with a few clicks.

Mobile App

Bluevine has a free mobile app to manage your business banking easily. The app also includes features like check deposits, transfers, and automated payments.

You can also send payments, manage bills, and deposit checks, all from the convenience of your smartphone.

Accounting Integrations

Bluevine integrates with accounting and bookkeeping software such as QuickBooks, Xero, and Expensify to help you easily track expenses.

Payment Integrations

Bluevine integrates with Stripe, PayPal, and Square POS to help you easily accept customer payments.

Fees & Pricing

Bluevine Fees and Pricing

| Monthly transactions: | Unlimited |

| Paper checks: | Up to 2 free checkbooks annually |

| Monthly fee: | $0 |

| Minimum balance: | $0 |

| Minimum required deposit: | $0 |

| Overdraft fee: | $0 |

| Bill pay with credit card: | 2.9% |

| Incoming ACH: | $0 |

| Outgoing ACH: | $0 |

| Depositing checks: | $0 |

| Incoming wire fee: | $0 |

| Outgoing wire fee: | $15.00 |

| Cash deposit fee: | $4.95 per deposit |

| In-network ATM fee: | $0 |

| Out-of-network ATM fee: | $2.50 |

| Debit card replacement fee (With express shipping): | $30.00 per shipment (1-2 business days) |

Who is it for?

Who is Bluevine for?

- Businesses that don't rely on physical locations: Small business owners looking for an online-only bank, Bluevine, may be the perfect fit since it has no physical branches.

- Businesses that want to earn interest on their idle funds without having a minimum balance: We put Bluevine on our list of the best free business checking accounts because it offers 2.0% APY on balances up to $100,000 if you meet the qualifying criteria.

- Single-owner sole-proprietors looking for an online-only bank: Bluevine is one of our top-recommended business checking accounts for startups because it has no minimum balance requirement, monthly fees, or minimum opening deposit.

- Single-owner LLCs that want only a business checking account: We chose Bluevine for our roundup of the best business checking accounts for LLCs because they offer a high-yield account with no fees.

- Businesses that need quick approval for funding: Bluevine's line of credit product offers a fast and straightforward application process, where businesses can get the financing they need quickly within a day.

- Business owners who need to maintain separate financial records: Bluevine offers up to five subaccounts, allowing you to track your budgets and expenses better; however, if this is a top priority, we recommend Relay Bank.

- Businesses that want to increase productivity and save time should integrate their existing software: Bluevine connects with QuickBooks, Xero, Wave, Expensify, Wise, and Square. This allows you to streamline your business operations by having all your data in one place.

- Business owners who want to share account access with their team: You can add additional people, like your accountants, to your account to help handle the bills and taxes for your business.

Who is it not for?

Who is Bluevine not for?

- You want in-person support from a banker: Bluevine is an online-only bank, which means they don't have any physical branches, and all customer service inquiries are handled over the phone or email.

- If you deposit cash frequently: Although Bluevine does allow cash deposits through their banking partner, Green Dot, each cash deposit costs $4.95, and you're limited to $2,000 a day. If you need more accessible options, consider a brick-and-mortar bank.

- You need multiple business debit cards: If you need more than one signer or debit card on your account, your business may have better options. Instead, try Lili Bank or Found Bank, where business debit cards can be issued to owners and authorized signers.

- You need an SBA loan: Bluevine currently offers a business checking account and line of credit, but if you need an SBA loan, consider signing up for Live Oak Bank.

Compare

Bluevine Vs. The Competition

No monthly fees or minimum opening deposit

Unlimited fee-free transactions

No physical locations

Cash deposits have a $4.95 per-time charge

Earn 1% cashback with its debit card

Unlimited fee-free transactions

No cash deposits or check ordering

$100 minimum opening deposit

No account minimums

Major accounting& payroll integrations

Does not offer APY on the business account

No 24/7 live support

Bluevine Vs. Grasshopper Bank

Both Bluevine and Grasshopper Bank offer business checking accounts with no monthly fees. However, the Bluevine business checking account offers 2.0% APY on balances up to $100,000 if you meet the qualifying criteria, while Grasshopper offers unlimited 1.51% on all deposited funds.

Grasshopper Bank also offers unlimited 1% cashback on its debit card spending, and Bluevine only offers up to cashback on select merchants. We recommended Bluevine to anyone who does not constantly use a business debit card and has less than $100,000 in cash. However, we recommend Grasshopper Bank if you have more than $100,000 in business cash or frequently use a business debit card consistently.

Bluevine Vs. Relay Bank

Relay Bank is an online-only bank that offers a business checking account with no fees and has up to 20 subaccounts. This allows you to keep track of your finances easily. Bluevine also offers 5 subaccounts, but the main difference between these two banks is that Relay Bank is much more geared to advanced accounting integrations with a multi-member business, while Bluevine is much better for single-member LLCs or sole-proprietorships.

Support

Bluevine Customer Support Hours

Live Chat

Live chat is available from 8:00 AM – 8:00 PM (ET) Monday – Friday, but you must be logged into the platform to access this feature.

For non-urgent issues, you can email Bluevine by using their contact form on their support site.

Phone

For urgent issues, you can call Bluevine at (888) 216-9619 from 8:00 AM – 8:00 PM (ET) Monday – Friday.

Bottom Line

Is Bluevine for you?

Bluevine is an excellent option for businesses that want to earn a competitive APY yield of 2.0% on their business cash and need access to up to five subaccounts. Additionally, Bluevine offers an array of financial integrations with QuickBooks, Xero, Wave, Expensify, Wise, and Square so you can streamline your business operations. If you prefer more involvement with a banker or need multiple debit cards for owners and authorized signers, there may be better options than Bluevine.

Ultimately, the Bluevine business checking account could be a great solution to increase efficiency in managing finances while earning more interest on your deposited funds. Its competitive rates and features make it worth trying for many small business owners. Additionally, having an account makes accessing its line of credit products easy, which offers competitive rates to save your business money.

FAQ

Bluevine FAQ

How long does it take for Bluevine to approve a PPP?

Bluevine typically processes PPP applications within 4-5 business days. If approved, your funds could reach your account in as little as 1 day.

Is Bluevine a legitimate bank?

Is Bluevine legit? The short answer is yes. Bluevine is not a bank but, rather, a financial technology company. It provides banking services but partners with Coastal Community Bank to provide FDIC insurance. Bluevine's line of credit product is issued by Celtic Bank, FDIC.

Does Bluevine run a credit check?

Bluevine's checking account may have a soft pull on your credit account, but it will not affect your credit score. However, a full credit check will be done if you apply for Bluevine's line of credit.

What is the minimum balance required to open Bluevine's business checking account?

There is no minimum balance requirement when opening an account.

What bank owns Bluevine?

Bluevine is partnered with Coastal Community Bank, which is FDIC-insured. Bluevine's line of credit is issued by Celtic Bank, FDIC.

Is Bluevine safe?

Yes, Bluevine is safe, and your money us protected up to $250,000 with FDIC insurance from banking partner Coastal Community Bank.