Overview

| Monthly fee: | $0/mo |

| Minimum Opening Deposit: | $100 |

| APY: | Up to 3.55% with an Innovator Money Market Savings Account |

| Transactions: | Unlimited |

| ATMs: | 45,000+ |

Who Is It For?

- Entrepreneurs, freelancers, and small business owners who need a low-cost banking solution

- Online-only businesses that don't deal with cash payments or deposits

What Is It?

What Is Grasshopper Bank?

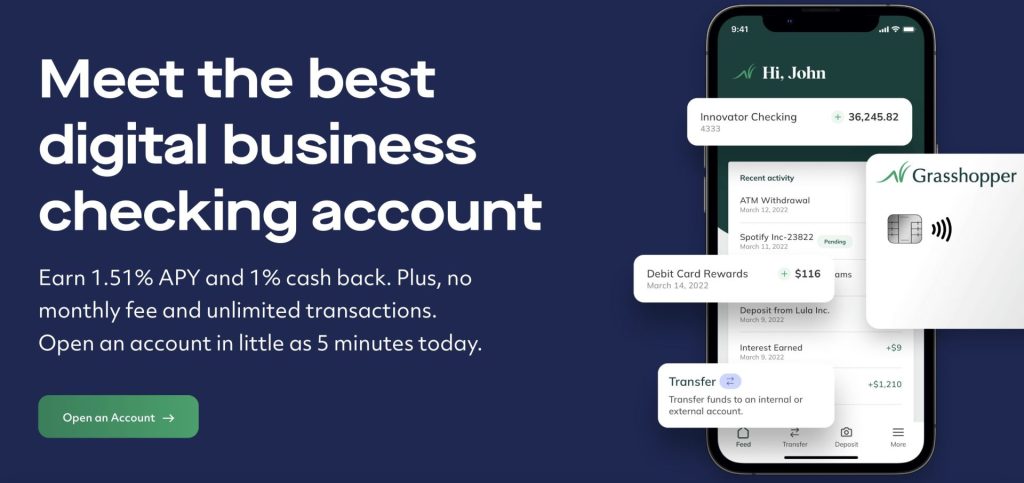

Grasshopper Bank is a financial institution that provides digital banking solutions to small businesses and entrepreneurs. It offers a variety of features that are perfect for entrepreneurs and early-stage businesses, such as a high-interest checking account, cashback debit card, and unlimited free transfers.

The bank was founded in 2019 and now holds approximately $733 million in assets. It is FDIC-insured and offers services exclusively online or through its mobile app.

The bank does offer other services for sectors like venture capital, fintech, and startups that need features like API capabilities. Still, in this review, we will only discuss its small business bank account.

Pros & Cons

Pros & Cons Of Grasshopper Bank

Features

Top Grasshopper Bank Features

Fee-Free Business Bank Account

You can open a Grasshopper business bank account with no monthly fees, minimum balance requirements, and overdraft fees. This digital checking account also provides unlimited fee-free transactions, so you can make as many deposits and withdrawals as you need without incurring any fees.

Cashback Debit Card

Grasshopper Bank's cashback debit card offers unlimited 1% cashback on all purchases, so you can earn rewards just by using your card for everyday expenses. There are no limits on how much cashback you can make, and the cashback rewards will be automatically deposited into your account each month.

Virtual Debit Cards

Grasshopper Bank offers virtual debit cards that can be used for online purchases or to pay vendors. These cards are free to create, and there are no monthly fees. You can also set spending limits and expiration dates on your virtual cards to help control your finances.

45,000+ Free ATMs

Grasshopper Bank has partnered with over 45,000 ATMs worldwide so that you can withdraw cash for free at any of these locations. You can use out-of-network ATMs, but you can be charged a fee when withdrawing.

Flexible Financing Solutions

Grasshopper Bank offers a variety of small business financing options to help you grow your business. You can apply for lines of credit, term loans, and merchant cash advances. The bank also offers SBA-backed loans, which can be used for various purposes, such as expanding your business, buying new equipment, or refinancing debt.

Dedicated Support

Grasshopper Bank has a dedicated support team to answer your questions during weekday business hours. You can contact the support team by phone, email, or live chat. They provide a unique, tailored approach based on your business's wants and needs.

Automated Bookkeeping

Grasshopper Bank offers automated bookkeeping so you can track your expenses and income without having to do it manually. The bank will categorize your transactions and provide you with monthly statements so you can see where your money is going, which will help you optimize your cash flow.

Mobile Check Deposit

You can deposit checks into your Grasshopper Bank account using the mobile app. Just take a picture of the check, which will be deposited into your account within 1-2 business days.

Digital Invoices

Grasshopper Bank allows you to create and send digital invoices to get paid faster. You can also set up recurring payments, so you don't have to worry about manually sending invoices each month.

Seamless Bill Pay

Grasshopper Bank makes it easy to pay your bills online. You can set up one-time or recurring payments, and the bank will automatically deduct the funds from your account. You can also view your payment history and track your spending to see where your money goes.

Fees

Grasshopper Bank Fees

| Monthly Fee: | $0.00/mo |

| Overdraft Fees: | No |

| ACH Transfer: | $0.00 |

| Returned Check: | $0.00 |

| In-Network ATM Withdraw: | $0.00 |

| Debit Card Replacement: | First Free, then $5/card |

| Foreign Transaction Fees: | No |

| Wire In (Domestic): | $0.00 |

| Wire Out (Domestic): | $10.00 |

| Wire In (International): | $5.00 |

| Wire Out (International): | $25.00 |

<br>Security

Grasshopper Bank Security

One of the biggest concerns for any business owner is the safety of their finances. Grasshopper Bank takes numerous measures to ensure that your funds are always safe. The bank employs state-of-the-art security features that help keep your data and money safe.

Grasshopper Bank is also FDIC insured, meaning your money is protected up to $250,000 per account. If the bank should fail, you will be compensated for your losses.

Contact

How To Contact Grasshopper Bank

Grasshopper Bank's hours are Monday – Friday: 9 am – 9 pm (ET), and it is closed on Saturday and Sunday.

Phone

+1 (888) 895-9685

Chat

Access Grasshopper's live chat on it's website.

Compare

How Does Grasshopper Bank Compare?

No account minimums

Major accounting& payroll integrations

No Cash deposits

No physical locations

Unlimited 2.2% cash back debit card

Discounts on services like Google Ads, Quickbooks, & more

Checking account does not earn interest

No physical locations

Major accounting & payroll integrations

24/7 live chat and email

Cannot send/receive international wires

No physical locations

Bottom Line

Is Grasshopper Bank For You?

Grasshopper Bank is an excellent option for small businesses looking for a bank that provides services to entrepreneurs and small business owners. It offers a variety of features, such as a high-interest digital checking account, cashback debit card, free incoming wires, and unlimited free transfers. The bank also employs state-of-the-art security measures to keep your data and money safe and secure. Grasshopper Bank is FDIC insured, so you can be assured that your funds are protected up to $250,000 per account.

However, if you are a medium-sized or larger company, consider a different bank that can offer you more robust services. Additionally, if you require 24/7 customer support or need to make cash deposits into your account, there are better banks than Grasshopper Bank for your business.

FAQ

Grasshopper Bank FAQ

Is Grasshopper a real bank?

Yes, Grasshopper is a real digital bank providing small businesses banking services. The bank is an FDIC member, meaning your deposits are protected up to $250,000.

How big is Grasshopper Bank?

Grasshopper Bank has approximately $733 million in assets as of late 2022.

Where does Grasshopper Bank have its headquarters?

Grasshopper Bank is headquartered in New York, NY.