Bad credit shouldn't hold you back from accessing essential banking services. With the right bank account, you can regain control of your finances and work towards improving your credit score. In this article, we'll dive into some of the best bank accounts for bad credit.

We've handpicked bank accounts that offer features tailored to the needs of those with less-than-perfect credit scores. These accounts provide a range of benefits, such as no credit checks, low fees, and credit-building tools to help you on your journey to financial stability.

Our top picks include a mix of online-only and traditional banks, ensuring everyone has an option. Whether you prefer the convenience of digital banking or the personalized support of physical branches, you'll find an account that suits your needs.

Free SoFi Credit Score

What are the best bank accounts for bad credit?

1. Chime

Chime offers a user-friendly, mobile-first banking experience with no credit checks required.

Features

- Free debit card

- No credit checks for account opening

- Automatic savings tools

- Early direct deposit

- Real-time transaction alerts

Pricing

- $0/mo with no minimum balance requirements

- Easy account opening process

- No hidden fees

- No physical branches

- Limited customer support options

Overall Thoughts

Chime is perfect for those with bad credit who want a simple, online-only banking solution without credit checks.

2. Current

Current provides a modern banking experience with flexible account options and no credit checks.

Features

- No minimum deposits or monthly fees

- Mobile banking app

- Instant transaction notifications

- Free overdraft up to $100

- Teen banking option available

Pricing

- $0/mo with qualifying activities

- User-friendly app

- Flexible account options

- Limited account types

- No joint accounts

Overall Thoughts

Current is a great choice for individuals with bad credit who want a modern, hassle-free banking experience.

3. GO2bank

GO2bank offers overdraft protection and credit-building tools, making it an excellent choice for those with bad credit.

Features

- Overdraft protection up to $200

- No monthly fees with qualifying activities

- Free credit monitoring and building tools

- Early direct deposit

- High-yield savings account

Pricing

- $0/mo with qualifying activities

- Overdraft protection

- Credit building tools

- Limited to mobile app

- ATM fees for out-of-network withdrawals

Overall Thoughts

GO2bank is an ideal option for customers with bad credit seeking overdraft protection and tools to improve their credit.

4. First Citizens Bank

First Citizens Bank is a traditional bank with physical branches and low minimum opening deposits.

Features

- Physical branch locations

- Low minimum opening deposit of $50

- No monthly fees

- Online and mobile banking

- Bill pay and eStatements

Pricing

- $0/mo with qualifying activities

- Access to physical branches

- Low minimum opening deposit

- Limited availability in certain states

- Potential fees for additional services

Overall Thoughts

First Citizens Bank is a solid choice for those with bad credit who prefer a more traditional banking experience with physical branches.

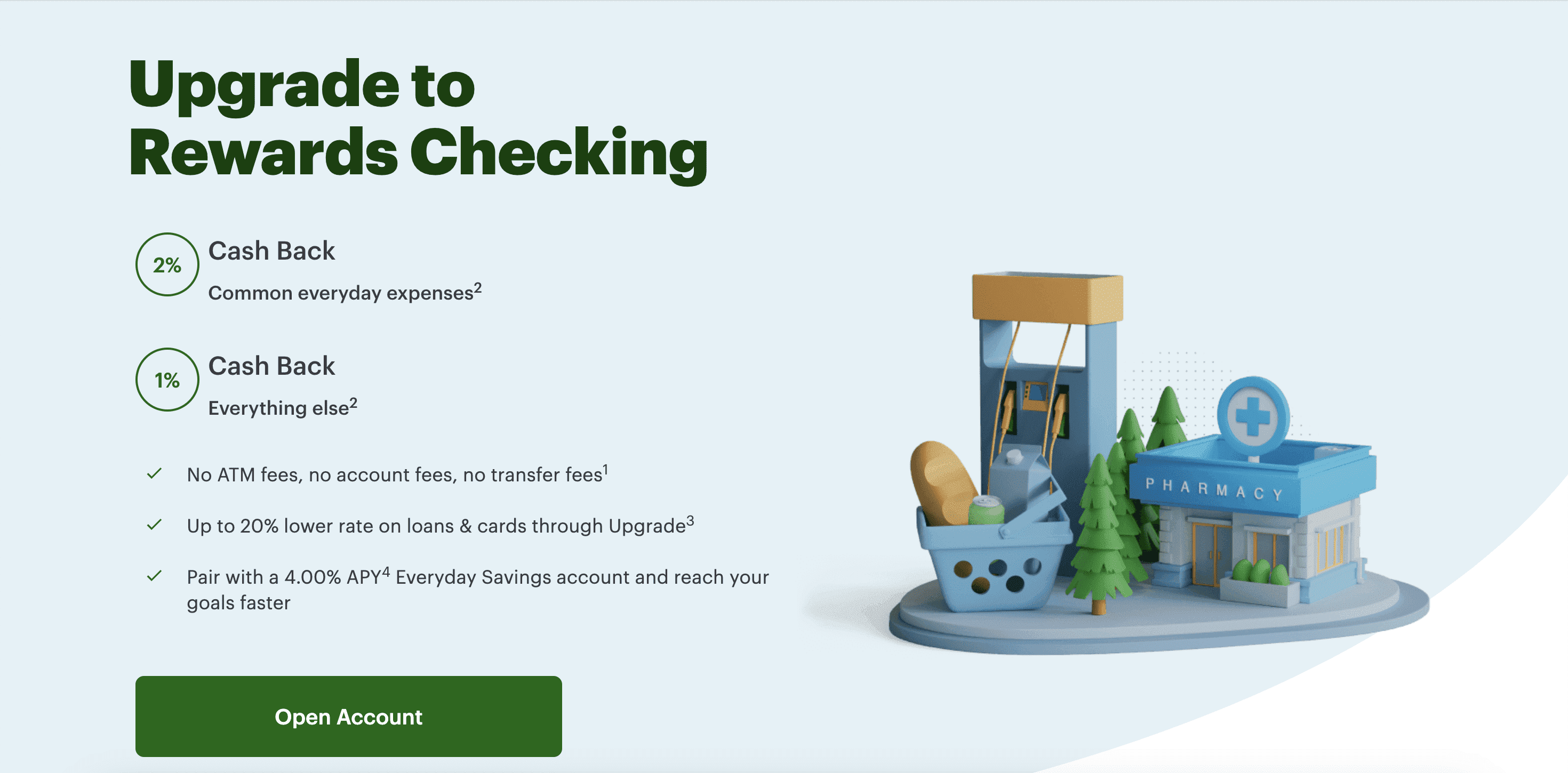

5. Upgrade

Upgrade offers a high-yield checking account and cash back debit card, perfect for individuals with bad credit.

Features

- High-yield checking account

- Cash back debit card

- Free credit monitoring tools

- No monthly fees

- Mobile banking app

Pricing

- $0/mo with qualifying activities

- Cashback rewards on debit card

- High-yield checkings & savings account

- No physical branches

- Limited account options

Overall Thoughts

Upgrade is a fantastic option for individuals with bad credit who want to earn cash back and build their credit with a high-yield checking account.

Bottom Line

Having bad credit doesn't mean you can't access reliable banking services. Chime, Current, Go2Bank, First Citizens Bank, and Upgrade all offer unique features and benefits for individuals with bad credit.

When choosing the right bank account for you, consider factors such as fees, credit-building tools, and whether you prefer online-only or traditional banking with physical branches. By selecting the right bank account, you can regain control of your finances and work towards improving your credit.

FAQ

Can I open a bank account with bad credit?

Yes, you can open a bank account with bad credit. Many banks, like the ones mentioned in this article, offer accounts without credit checks, making it easier for individuals with bad credit to access essential banking services.

How can I improve my credit using a bank account?

Some bank accounts offer credit-building tools, like reporting on-time payments to credit bureaus or offering secured credit cards. Banks such as Go2Bank and Upgrade, mentioned in this article, provide free credit monitoring and building tools. By using these tools and making responsible financial decisions, such as paying bills on time and maintaining low balances, you can gradually improve your credit score.

Are there any fees associated with bank accounts for bad credit?

Fees for bank accounts vary depending on the bank and account type. Many of the banks mentioned in this article, like Chime, Current, and Upgrade, have no monthly fees with qualifying activities. However, it's essential to read the account terms and conditions to understand any potential fees associated with the account, such as ATM withdrawal fees or fees for additional services.

Can I get a debit card with a bank account for bad credit?

Yes, most bank accounts for bad credit come with a free debit card. Banks like Chime and Current provide free debit cards, allowing you to make purchases, withdraw cash from ATMs, and manage your money conveniently.

How do I choose the best bank account for my needs with bad credit?

To choose the best bank account for your needs with bad credit, consider factors such as fees, account features, credit-building tools, and customer support. Also, consider whether you prefer online-only banking or traditional banking with physical branches. By evaluating these factors and comparing banks like Chime, Current, Go2Bank, First Citizens Bank, and Upgrade, you can find the right bank account to help you regain financial control and improve your credit.