Webull Tax Documents (Explained): How To Access & Download

Are you looking for information on how to access your Webull tax documents? In this post, we will walk you through accessing your tax documents from Webull and when you can expect your forms to be available. Remember that this process may vary depending on the year you are trying to obtain your documents and if you have an active account with Webull.

How To Access Your Webull Tax Documents?

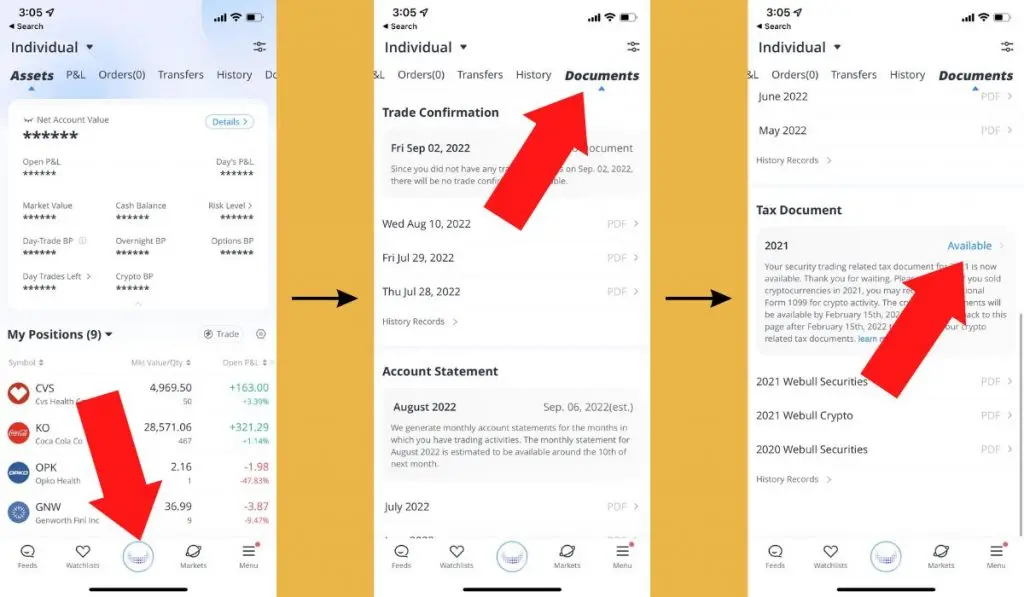

Mobile Device:

- Open the Webull app

- Navigate to the home page

- Tap documents

- Select the “Tax Document” section

- Download and view your tax report

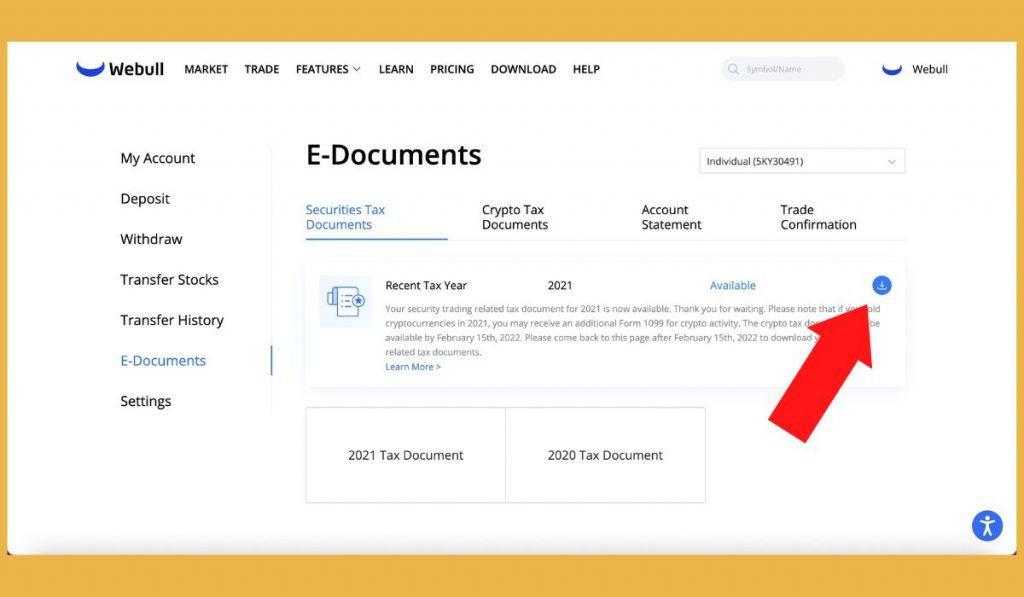

Desktop Computer:

- Login on the official Webull website

- Navigate to the E-Documents page

- Authenticate with your trading password

- Download and view your tax report

Does Webull Report To The IRS?

All brokerages are legally obligated to report to the IRS. For Webull, they will provide the IRS with tax information if you have earned over $600 in dividends or interest in a calendar year. Webull will not provide the IRS with your information if you have not reached this threshold.

When Does Webull Release Tax Documents?

Webull will release tax documents (Form 1099) as soon as they are available from the exchanges. For most users, this is in early February. However, it can take up to late February or early March for all forms to be completed and released. Webull will also email you and send a notification on the app when your documents are ready to be downloaded.

You will also receive paper documents sent to the address on file during your account setup if you had over $600 in dividends or interest and did not consent to receive electronic forms.

What Tax Documents Does Webull Provide?

Webull provides a consolidated Form 1099, which includes forms 1099-B, 1099-DIV, 1099-INT, and 1099-MISC.

1099-B: This form reports information related to the sale of securities such as stocks, bonds, and mutual funds.

1099-DIV: This form reports information related to any dividends or capital gains distributions that you have received from your investments.

1099-INT: This form reports information related to any interest that you have earned from your investments.

1099-MISC: This form reports information related to any miscellaneous income that you have earned from your investments. This can include things such as royalties, Webull stock referrals, and more.

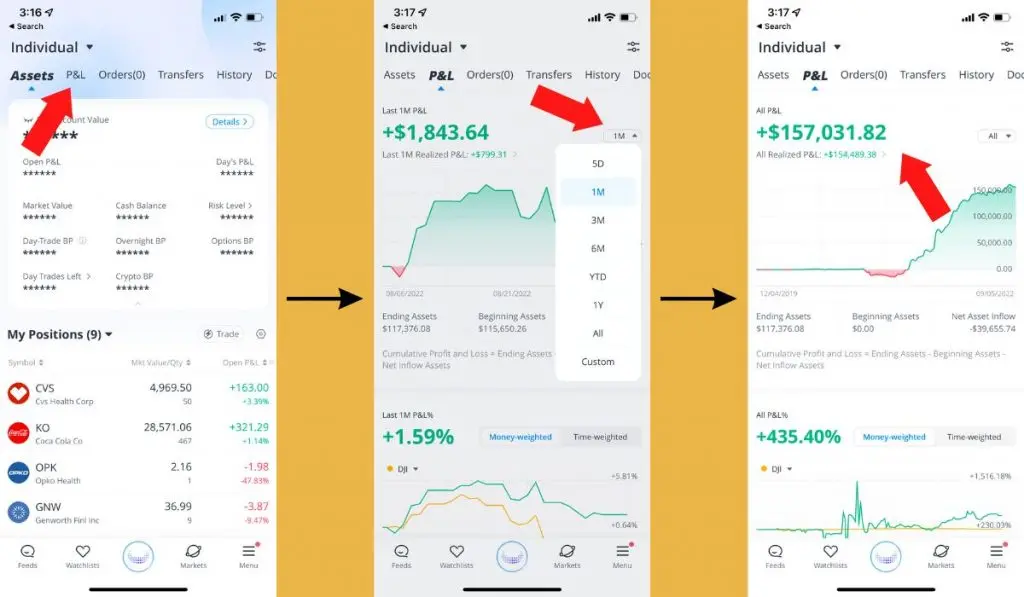

How To See Capital Gains On Webull

- Open the Webull app

- Navigate to the home page

- Select P&L

- Choose a specific timeframe

- See your total profit and loss from trading, dividends, and more

Bottom Line

Webull

Remember that all brokerages are legally obligated to report to the IRS. If you have earned over $600 in dividends or interest in a calendar year, Webull will provide the IRS with your information. Webull will not provide the IRS with your information if you have not reached this threshold. If you lose money in the stock market, it may also be worth reporting your losses to the IRS to save more on taxes.

When do Webull tax documents come out?

Webull will release tax documents in early February. However, it can take up to late February or early March for all forms to be completed and released.

When does Webull send out 1099?

1099's will only be sent out if you have earned over $600 in dividends or interest in a calendar year. Usually, it will be sent in early February electronically or my mail.